How to Create an Annual Budget Report

Updated by Xtensio

Your annual budget report should quickly generate an accurate and reliable overview of your organization’s budgeted and actual expenses, along with your cash flow statement. A good budget report will help assess key financial, operating, and competitive metrics so you can reach your growth goals. Use this step-by-step guide to create your own budgeting report easily.

Follow along and explore this template.

Xtensio is your team space for beautiful living documents.

Create, manage and share business collateral, easily.

Table Of Contents

Overview of a detailed budget report

An Annual Budget Report is a powerful tool that helps organizations map out a financial roadmap. It is the compass that guides through the fiscal year, helping businesses navigate the waters of revenue and actual expense.

In simpler terms, these reports are comprehensive budget projections of the income and expenses over a year. It accounts for all sources of financial income – from sales and investments to loans and more. It also includes anticipated expenditures such as salaries, operating costs, debt repayments, and investment outlays. The key objective is to provide a detailed picture of the financial health of a business or individual, enabling informed decisions and strategic planning.

A critical component of the financial report is ‘net operating income’. It refers to the income generated from the core operations of a business, minus the operating expenses. It’s a way to see how well a business is doing from just its day-to-day activities, like selling goods or providing services. We’re not worrying about things like bank loans, taxes, or how the business is funded here. It’s the heartbeat of any company, showing us how much money it makes from what it does best.

So, if you are looking to gain a better grasp of the Annual Budget Report and how to build one with ease, we got everything you need, from examples to templates!

The look and Feel of Your Budgeting Reports should follow your company’s branding and be easy to follow and understand.

Your guide to creating interactive annual budget reports for your organization

The yearly budget report aids in the documentation and recording of financial data throughout the year. We recommend updating it regularly to receive a regular picture of your company’s finances including critical information about budget deficit, and to make it easy to finish at the end of the year.

The annual budget report will allow you to:

- Create visually-rich, annual and monthly estimated budget reports. Add links, articles, sheets and more.

- Quickly generate an accurate and reliable overview of your organization’s projected income and actual expenses and cash flow.

- Assess key financial, operating, and competitive metrics.

The annual budgeting process should include members of all the departments within your company to get a full view of your organization’s financials and cash flow. To edit, invite your team to participate. Share the link with your management team and key external stakeholders to keep them up to date.

How to create an Annual Budget Report?

Creating an Annual Budget Report is a vital process that allows businesses to plan for the future, allocate resources effectively, and achieve financial goals. However, it can be a daunting or time consuming task if you don’t know where to start. Here’s the step-by-step guide on how to create an Annual Budget Report.

Step 1: Determine the Accounting Period

The first step in creating an Annual Budget Report is to determine the accounting period. It’s usually a 12-month period over which a company measures its financial performance. Most companies align their accounting period with the calendar year, but it can also overlap with the fiscal year if different. The accounting period forms the timeframe for your annual budget.

Step 2: Identify Business Units

Next, identify the different business units within your organization. A business unit can be an individual department or a division within the company, each having its own set of revenues and expenses. You should be able to understand these units as each will have its own section within the Annual Budget Report. This step ensures that every part of the business is considered when planning for the year ahead.

Step 3: Establish Financial Goals

The third step is to establish your financial goals for the accounting period. This involves determining what the company hopes to achieve financially within the year. Goals could include increasing revenue, reducing costs, expanding into new markets, or investing in new equipment or technology. These financial goals will guide the allocation of resources in your budget.

Step 4: Collaborate with Finance Leaders

Creating an Annual Budget Report is a team effort. It’s important to collaborate with finance leaders within your organization as they provide valuable insight into the financial health of the company. The finance leaders can assist in analyzing past performance, predicting future trends, and making informed decisions about the allocation of resources.

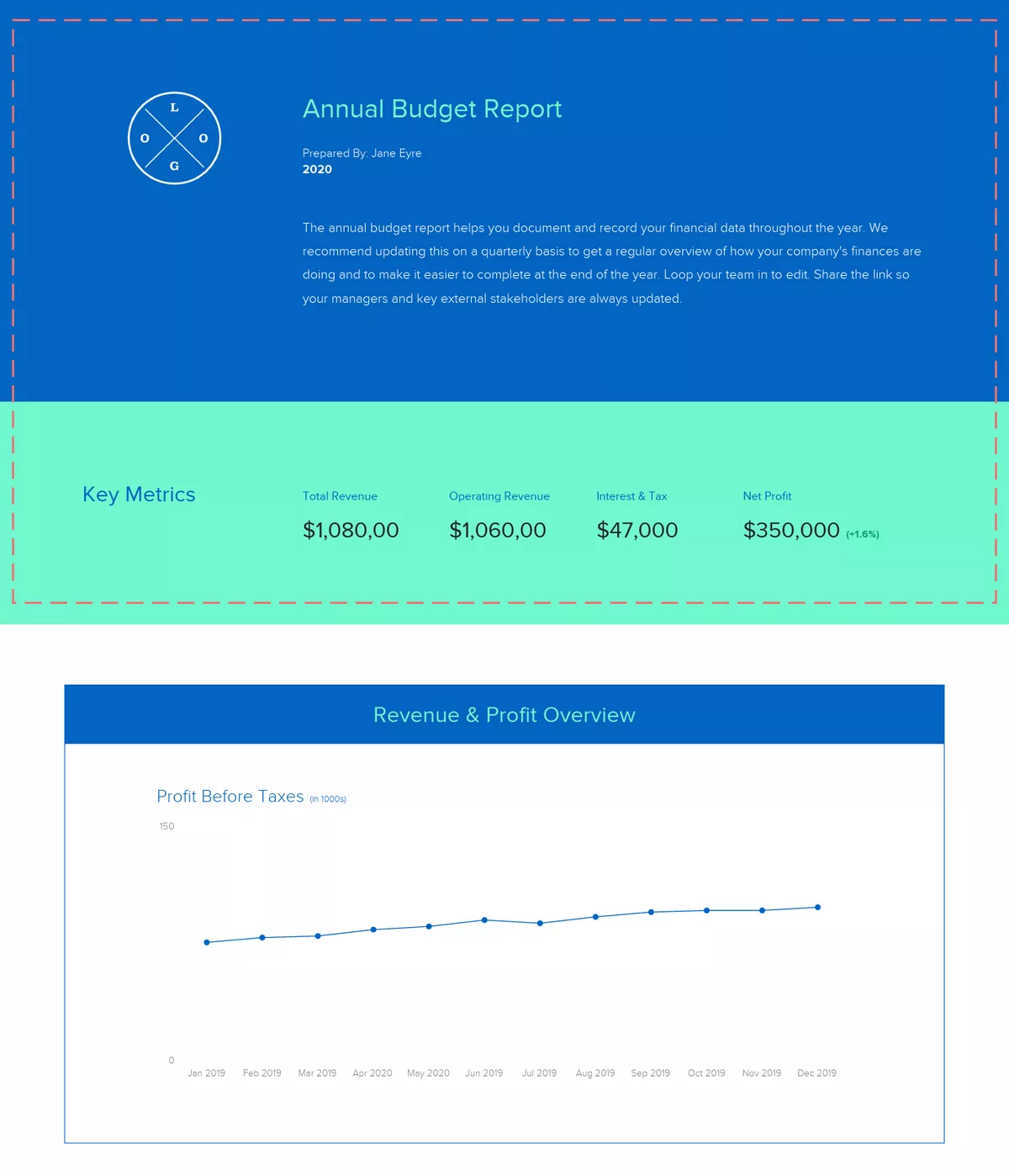

Include key metrics on annual cash flow, expenses, income statement and net profit, and give an overview of how your company’s finances are doing in the cover section. Add backgrounds and change color schemes to match your brand styles.

Create an overview outlining your key metrics

Include key metrics on annual cash flow, expenses, income statement and net profit, and give an overview of how your company’s finances are doing in the cover section. Add backgrounds and change color schemes to match your brand.

Include key metrics on annual cash flow, expenses, income statement and net profit, and give an overview of how your company’s finances are doing in the cover section. Add backgrounds and change color schemes to match your brand.

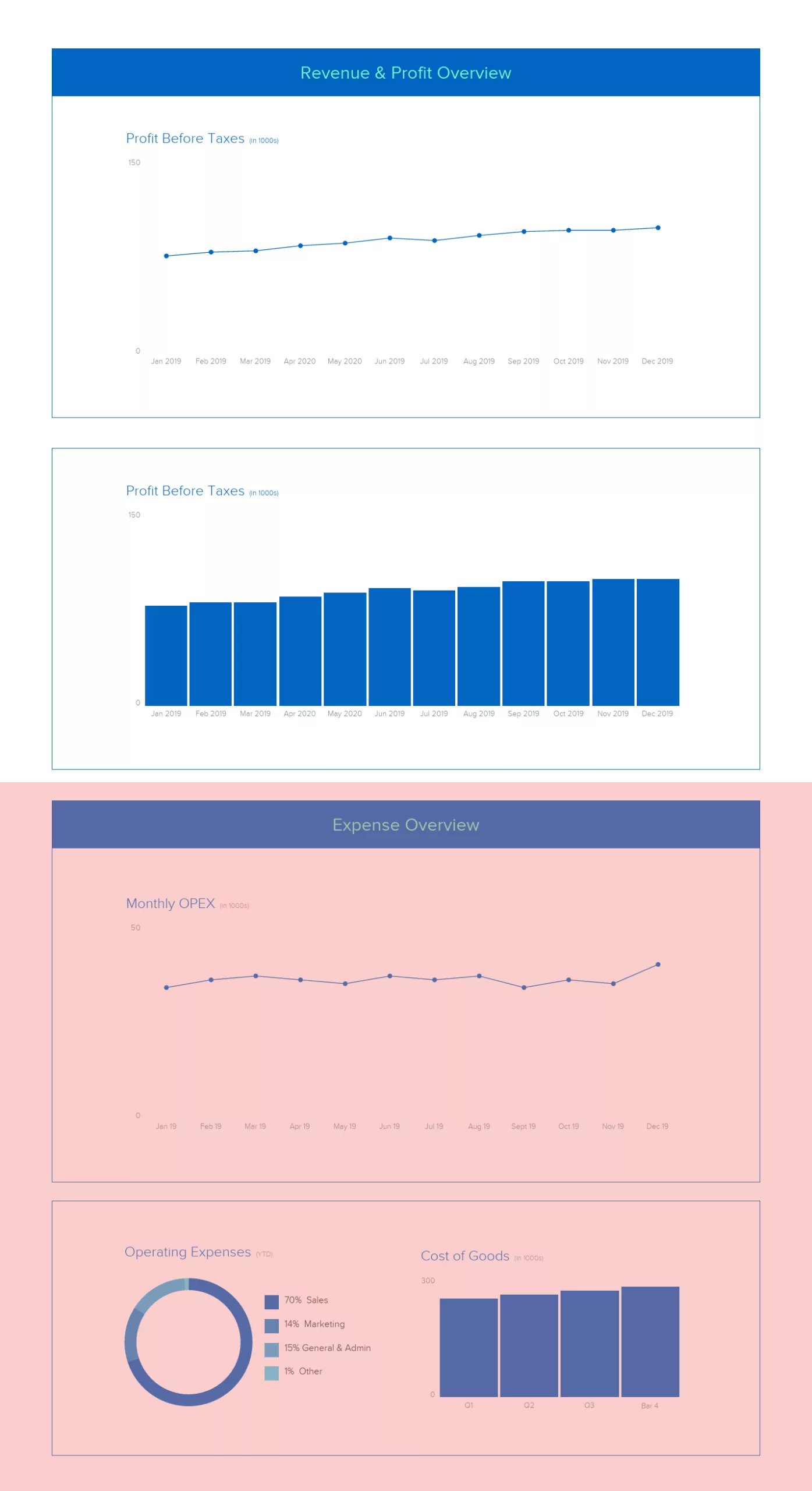

Detail annual revenue and profit

Most companies use charts and graphs to visualize the data and keep in mind that expected sales have a significant influence on costs. When making projections:

- Research industry guides, best practices and other thought-leader publications that focus on your industry. Look at financial information from your competitors, if available.

- Determine your recent monthly growth rate and whether this rate can be continued.

- Communicate with your current customers to better understand their expected needs of your product or service.

- Discuss the expected sales with your sales and marketing departments to help set expectations.

Calculate your annual expenses

After outlining your annual revenue and profit, analyze your operating expenses – what percentage of your operating expenses go towards each department? You should also include the cost of goods and services needed to run your business.

A few things to consider when determining your annual expenses:

- Fixed costs are typically the easiest to calculate and include rent, insurance, leases and other set costs.

- Some of your annual costs directly relate to your revenue (i.e. inventory and/or employee services). The gross margin of your business shouldn’t fluctuate greatly year after year unless new products or services are introduced. Use this data to identify cost savings.

- Employee compensation and headcount are critical in budgeting. Identify when you will need to hire, how long the hiring process takes and establish employee compensation to be in-line with revenues and growth in the coming year.

Example: Shortage of consultants at operating level rather than partner level. Unable to deal with multi-disciplinary assignments because of size or lack of ability.

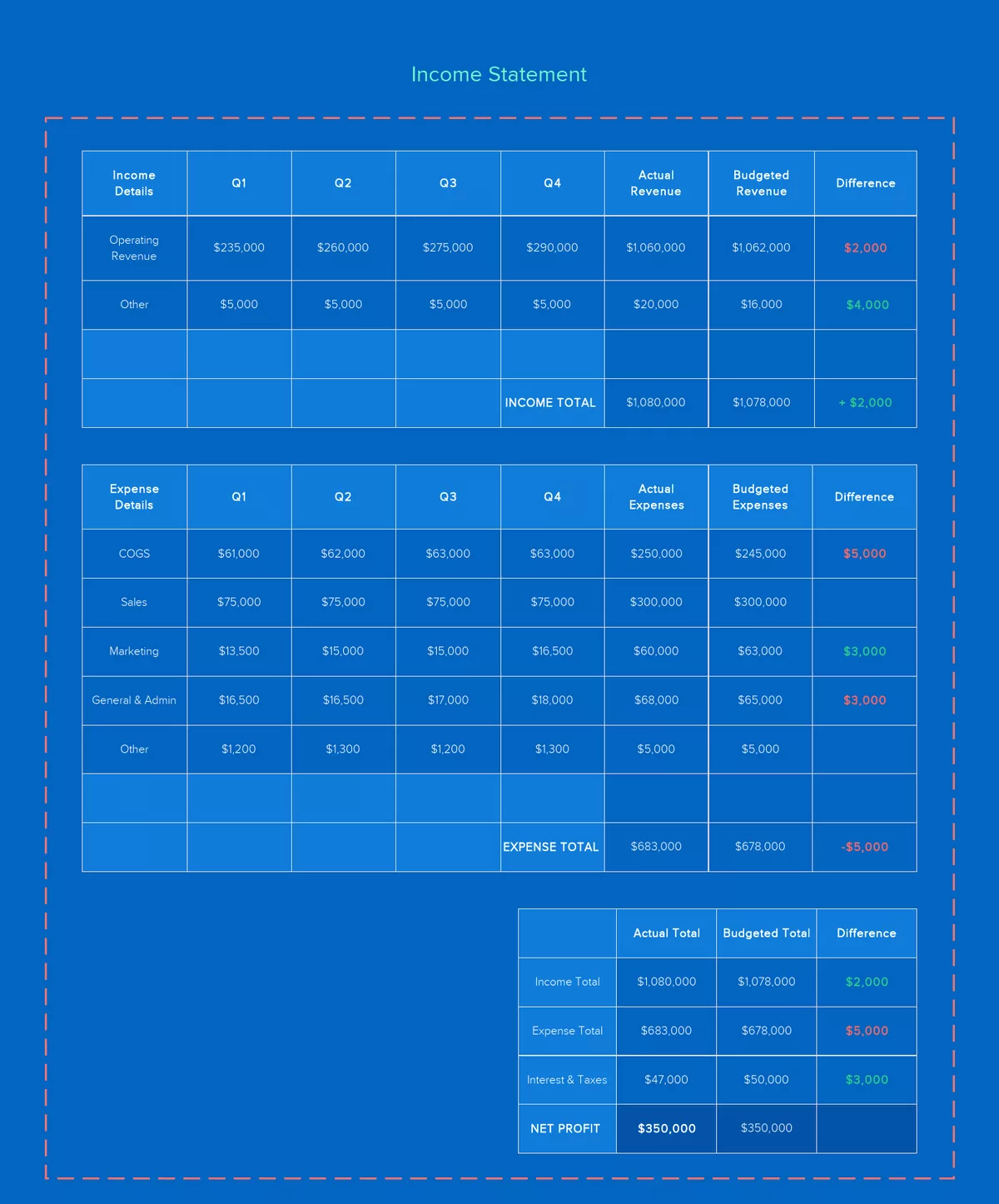

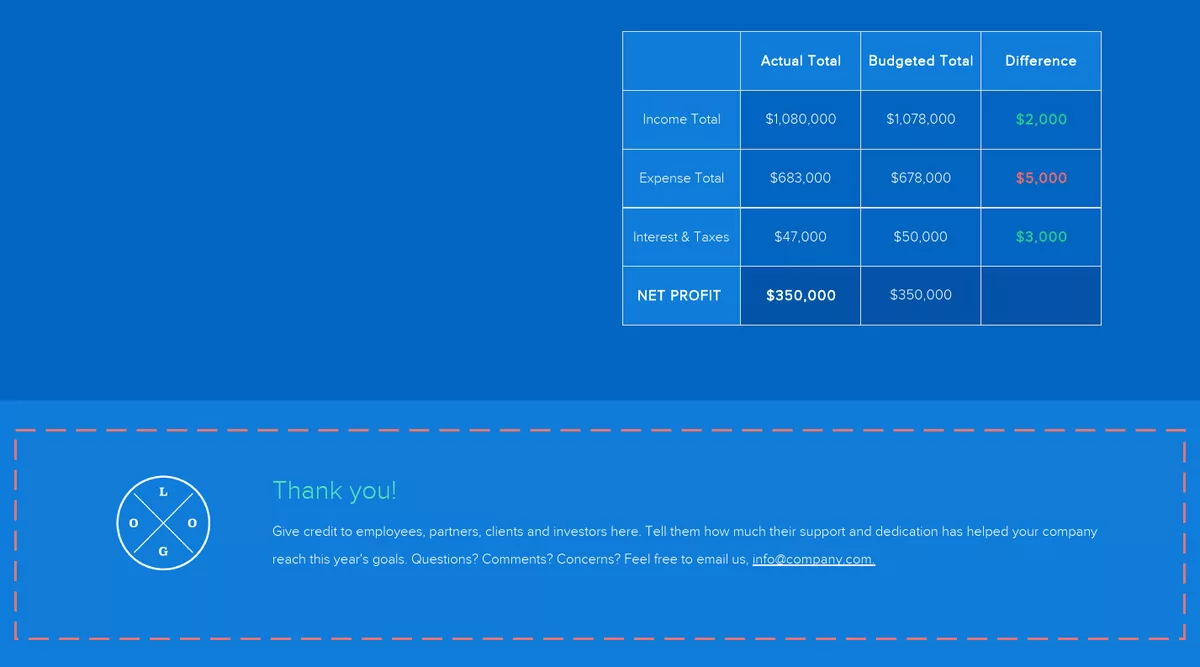

Include a table to detail your annual income statement

Detail your annual income and expense numbers in addition to the visual graphs and charts. This will help you analyze specific costs and profit avenues so you can plan for savings and growth in the next year.

Quick Tip: Along with the Annual Budget Report template, you can add task list modules to update the status of each item and keep track of the live document as the project moves along so all stakeholders can maintain visibility into what’s in progress, what’s next and what’s completed. Change statuses as you go and share the link to keep both your team and management always on the same page.

Add a footer and give credit to key stakeholders

Close the report by giving credit to employees, partners, clients and investors. Tell them how much their support and dedication has helped your company reach this year’s goals. Include your logo and contact info so external stakeholders and potential investors can easily get in touch with you.

Share your budget report as a link, monitor & evaluate

When you’ve finished creating your annual budget report with Xtensio’s editor, you can send the live link to your folio to share it as a responsive webpage (and add password protection). The budget report template is adaptable just like other Xtensio tools, it can and should be repurposed, revisited, and revised regularly throughout the year – we recommend quarterly.

Design, manage and share beautiful living documents… easily, together. Explore Xtensio

- Click and edit anything… together.

- Customize to match your branding.

- Share with a link, present, embed or download.